You already have so many priorities to worry about as a small business owner, health insurance does not need to be an added stress. When it comes to covering you, your family, and potentially your employees – these are the options you have at your disposal.

Affordable Care Act:

Commonly known as Major Medical insurance, the ACA has several components. ACA subsidies are determined by gross annual income. It’s often expensive without premium subsidies. The income range to receive a subsidy largely depends on how many people are in your household, your state, and the zip code. Using HealthSherpa.com, you can easily find out if you’ll qualify for any subsidy.

Here are the pros of the ACA:

- Possesses the 10 essential health benefits.

- May qualify for Cost Sharing Reduction on top of the subsidy.

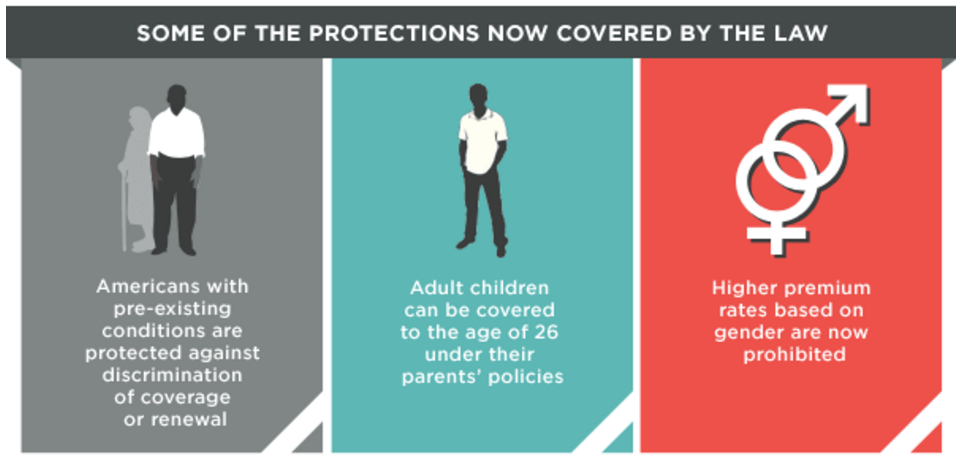

- These plans are guaranteed issue: there is no review of the insured’s health status or pre-existing conditions.

- Broad coverage for many generic, brand name, and specialty drugs.

Here are the cons of the ACA:

- Often expensive without premium subsidies.

- Very high deductibles.

- Many plans limit the insured to a narrow network of healthcare providers. This quick article does a good job explaining all three networks.

- Cannot enroll in a plan outside of the annual Open Enrollment Period, unless you’ve experienced a Qualified Life Event (QLE). If you have, you are given a 60-day window to acquire an ACA plan.

- If you’re traveling outside your state, you only have emergency coverage.

Short Term Coverage:

Short Term (STM) coverage operates similarly to the ACA or Major Medical plans. Nowadays, STM policies have been given options that extend from 3 months to 3 years. If you’re not getting insurance during open enrollment or don’t have a QLE; a short term plan is most likely going to be your best option as a small business owner.

Here are the pros of STM:

- Affordable premiums that can cost substantially less, sometimes even half of what is charged for an ACA plan.

- Even employees can benefit from STM if they’re in between jobs and need insurance coverage. This is a much better choice than paying the infinitely more expensive COBRA.

- STM insurance has a broad network (typically PPOs) of healthcare providers and is widely accepted at many of the top hospitals in the U.S.

- Year-round applications for insurance that are NOT contingent on the Open Enrollment Period.

- As of 2019, the penalty for not having Minimal Essential Coverage is no longer in place.

Here are the cons of STM:

- It does NOT provide coverage for pre-existing medical conditions. (Some guaranteed issue plans do offer prex coverage after a 3-month, 12-month, or 24-month waiting period. Talk to your broker to figure out options.)

- Pre-existing conditions are considered part of the medical underwriting process and can result in a denial of coverage. The National Association of Insurance Commissioners (NAIC) released a great “What You Need to Know” article for health insurance.

- Typically Rx coverage is not built into the STM plans but can be added as a stand-alone prescription drug policy.

- Some benefits, like maternity coverage, are not covered and excluded. However, you may ask your broker if there are maternity policies that can be added to the STM.

Fixed-Indemnity Insurance:

Unlike the other two options, a fixed indemnity (or fixed benefit) policy operates on what’s called a “first-dollar” amount. For more details, United Healthcare does a great job explaining what exactly a fixed-indemnity policy will do for you.

Here are the pros of fixed indemnity:

- Since these policies pay “first-dollar” or a fixed amount for each specific event; they tend to not have deductibles. (Some may if you stay overnight in a hospital.)

- Affordable premiums and most plans include additional wellness benefits such as Teladoc. STM also offers this benefit most of this time through their association.

- Prescription discounts often included and these policies are also not limited to the Open Enrollment Period.

- It can be a good alternative to a short term policy in the event your budget is tight. However, you want your broker to do their research in your state to see how much hospital costs, etc.

Here are the cons of fixed indemnity:

- Pre-existing conditions will most likely not be covered within the first 12 months of coverage.

- Capped medical benefits coverage at a rate much lower than major medical plans. Fixed indemnity plans don’t have what’s called “stop-loss”.

- If your medical expenses do not fall under specific events, then there will be no coverage payout.

- General illnesses like diabetes or conditions such as pregnancy don’t have benefits.

Regardless of what policy you choose to purchase for your health insurance, make sure you have a knowledgable broker who can simplify these definitions and pinpoint which one best caters to your needs. The purpose of health insurance is to prevent probable medical expenses in the future. An in-depth understanding of your policy eradicates needless stress or worry, and allows you to spend more time building your business with confidence.